Contractor Kickstart! Part 1: Budgeting & Pricing

Estimated Read Time: 6 minutes11-03-2023

Hey, aspiring contractors! If you've found your way to this blog post, chances are you're embarking on your journey of owning and running a successful independent construction company and have some questions on where to start. The team at Jet Insurance is committed to ensuring you’re well-prepared as you dive into the exciting world of contracting.

This is the first installment of a six-part blog series called “Contractor Kickstart!” where Jet passes on the knowledge of how to become a contractor. This series will cover topics like how to save your hard-earned cash, make savvy investments in top-notch tools, and efficiently manage your projects.

In this piece, we're tackling budgeting and pricing. We get it—starting out as a contractor means opening that wallet up wide, and we're here to help you do it right.

Budgeting: The Nitty-Gritty

It’s no question that becoming a contractor isn’t a walk in the park. On top of the hours of hands-on training and exams to complete, it also costs a pretty penny while you’re getting licensed.

The best way for a contractor to ensure they’re being smart with their money is to account for all the money coming in and going out, known commonly as creating a budget. Budgets are typically a part of your initial business plan. Don’t worry—we will go more in-depth with how to create a formal business plan in a future installment of “Contractor Kickstart!”

Every independent contractor’s budget is going to look different, especially when considering that every specific classification has its own unique needs. If you’re curious about all the different license classifications that exist, Jet has whipped up a handy guide outlining the classifications in depth.

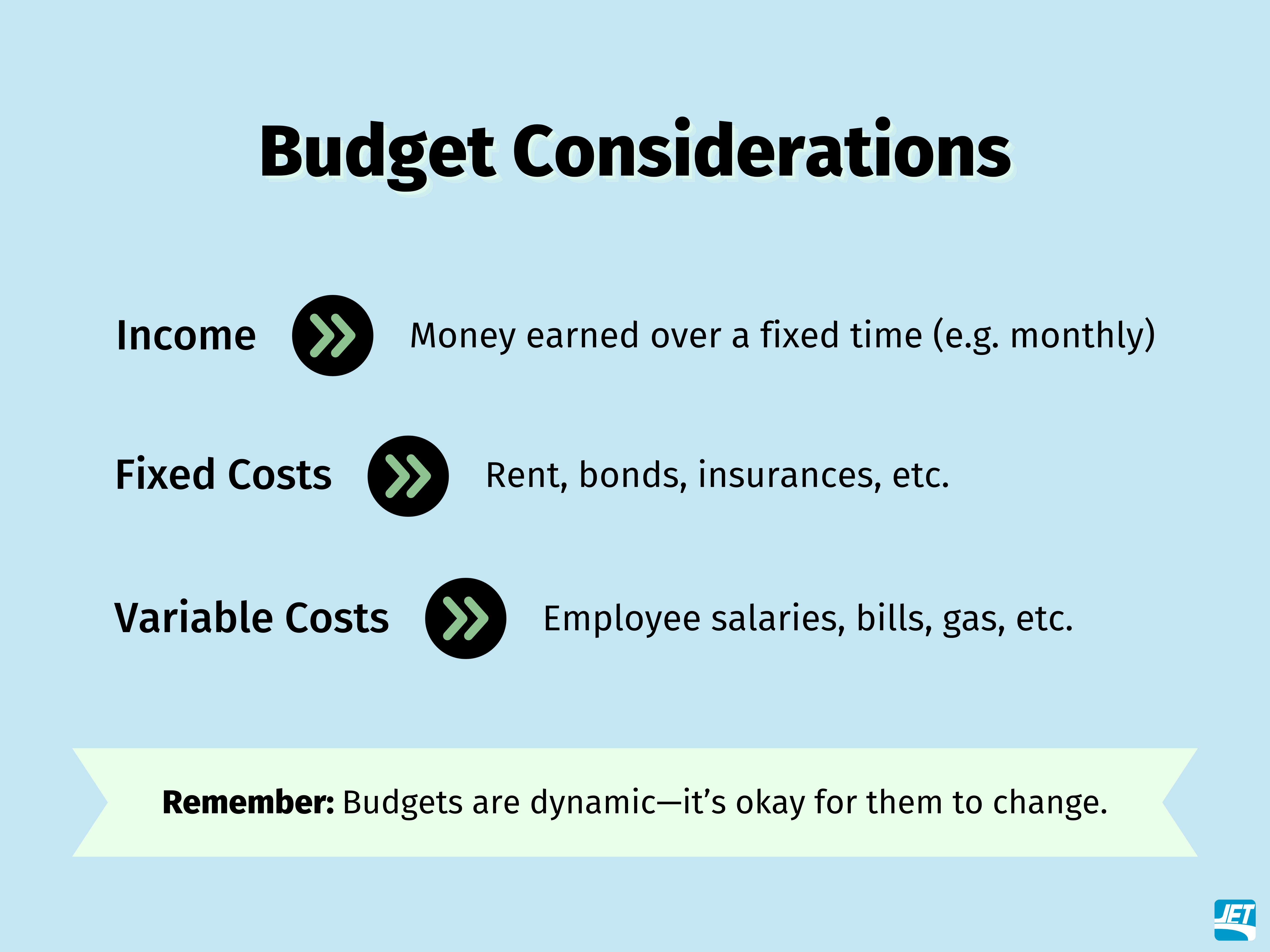

Definition of Cost Types

- Income: Money that you earn as a result of working or other means. This can be split into two different categories.

- Gross income: the total amount of money that you make from a job.

- Net income: the amount of money that you’re able to pocket after all the expenses are paid for (e.g. supplies, wages, etc.)

- Fixed Cost: an item that has one set price. If you need to purchase a fixed-cost item multiple times, you may have heard of this referred to as a “recurring” cost, which means that this is a purchase that repeats over a period of time.

- Variable Cost: an item that has a constantly-changing price tag every time you purchase it.

When it comes to fixed costs, it’s handy to think about how often you’ll need to purchase the items. For example, a contractor license bond will typically need to be purchased at least once a year, unless you purchase a multi-year bond. For variable costs, it’s helpful to calculate both a high end and a low end for those costs so that you have an idea of the cost range you might fall into. If you’re a brand new business with no income yet, you can estimate your financial projections based on the different types of jobs you might take on or what your competitors price their services at.

After a budget is created, you want to make sure you’re reviewing the budget from time to time. A good rule of thumb for budgeting beginners is to review your budget every month. As you get more familiar with what you’re spending your money on and the income you bring in, you can reduce this review to once every quarter (roughly every three months). This allows you to have a good amount of financial data to work off of, create more robust projections and ultimately see if you are on track to hit the monetary goals laid out for your business within your budget.

If you don’t have any clients yet…

A critical budget consideration is the invoiced prices for the services your company will offer. Of course, you don’t want to overprice your services to the point where clients don’t even consider hiring you. On the flip side, you don’t want to make the mistake of what new contractors and small business owners sometimes do by underpricing themselves.

It may seem tempting in the beginning to offer services for less than competitors, especially to get bids and contracts for jobs when you’re initially unknown in the local market. Still, it’s important to consider the necessity to set prices high enough to cover the cost of the job AND make a profit (at the very least). Don’t fall victim to underpricing yourself, taking on a contract, and then not being able to afford to get the job done.

What’s even worse is that you undervalue your work; it can send the wrong message to your new clients. You know the saying, “you get what you pay for?” People can equate cheap prices with cheap labor, so make sure your prices don’t look too good to be true.

Similar to individualized budgets, how you price your services will differ from other contractors. You might have a good idea of what your pricing should be after working alongside different contractors during apprenticeships, but here are some things you may overlook.

- Overhead: What are the different costs that are involved in order for you to start and sustain your business?

- Competitor Pricing: Conduct some market research to see what your competitors price themselves at so you can ensure you are pricing yourself competitively.

- Billable Hours: You’re not going to want to work forever, so consider how many hours you want to put in per week, month, year, etc. Are you pricing your services at a price that fits in with the lifestyle you want to live?

- Experience: Newer contractors are going to have different prices than seasoned professionals. More than likely, when you’re starting out, your prices are going to be lower than a contractor who has over 25 years of experience in the field.

- Profit Margin: Because your contracts and bids include all the prices necessary to get the job done, think about what percentage of your contract amount you want to take home as profit.

- Labor Costs: If you have any employees or subcontractors that you’ve hired for some jobs, factor in the prices necessary to keep them employed!

Budgeting is just one part of the equation for new contractors to think about. One of the best parts about working for yourself is that you have 100% control of where your money goes—for better or worse. Figure out your priorities early on so as to save yourself the headache of addressing any potential financial crises. Questions like, “do I want to spend more on my everyday tools or do I want to spend more on ads?” can save you a ton of time and hassle in the long run.

That brings us to the end of our first installment of “Contractor Kickstart!” We trust that you've discovered valuable insights on effectively managing your budget, whether you’re a freshly licensed contractor or a seasoned pro. Your financial success is key to your professional journey, and we're here to support you every step of the way.

Access other Contractor Kickstart! articles: