Factors That Determine Your Surety Bond Cost

Estimated Read Time: 5 minutes12-01-2022

Discover what determines the cost of surety bonds and how to get the surety bond you need.

With over 9,000 surety bond types in the United States, there are several factors that determine the price you’ll pay for your bond—including the bond type, bond limit, credit score, business experience, and more.

The surety bond provides a way for financially harmed individuals or entities to receive compensation after a regulated business or individual has been negligent or committed fraud.

This article covers all the details you need to understand surety bond pricing.

Bond Type and Limit

The type of bond you’re required to obtain has the biggest impact on the price. There are various industries, professions, and jobs that require surety bonds to afford fiscal protection to the public when dealing with licensed businesses and individuals. Some of these include notary publics, contractors, motor vehicle dealers, and court/probate cases.

In addition to the type of surety bond, the bond limit (aka the bond amount) is another leading factor in the price. Generally, bonds with larger limits carry more risk due to there being more compensation capacity available for claim payouts—this often leads to higher bond costs.

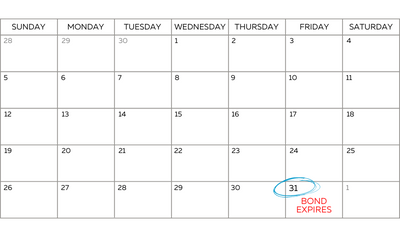

The bond limit is the total dollar amount that claims can be filed for in a bond’s term. For example, if a contractor files a $25,000 bond annually, the bond can pay claimants up to $25,000 each year.

For more information on bond claims, read the Surety Bond Claims Guide.

Examples

Notary Bond limits vary from state to state but are generally between $500 and $2,500. Notary bonds have a fixed rate and don’t require a credit check to be approved. Read Jet’s Notary Bonds page for more information.,

Contractor License Bond limits are determined by the obligee (regulatory agency). The obligee sets the limit based on (1) a set amount for all contractors, (2) the type of construction work being completed, or (3) the dollar amount of work being performed annually.

Bond limits for motor vehicle dealers depend on how much financial protection the State believes is needed for the dealership, generally ranging from $5,000 to $100,000. The type of vehicles (new, used, wholesale) being sold has a factor on the bond limit in addition to other factors. Read more information on our Auto Dealer Bonds page.

Court Bonds and Probate Bonds are required in certain instances where a guardian or fiduciary is appointed to represent a person and/or their estate. The bond limit is determined by the local court primarily based on estate assets and the complication of the case.

Bonds needed for contract/performance bonds have limits based on the size of the project.

Personal Credit Score

Surety companies often look at your financial health through a soft credit check. This isn’t mandatory for all surety bonds, though. Examples of bonds that are “instant issue”, meaning there is no credit check required, include notary bonds, lost title bonds, and low-limit contractor license/permit bonds.

For the bonds that do require a credit check, which is the majority, it’s a soft credit check. A soft credit check doesn’t pull a full report and doesn’t affect credit scores. Instead, it simply takes a “snapshot” of the applicant’s credit portfolio. The credit check helps the surety company determine the risk of writing the surety bond.

Think of your surety bond as a line of credit—if it is used, you are required to restore it by repayment to the surety company. Your credit history will give an idea of whether you will be more likely to comply with claim reimbursement.

Showing that you make payments in a timely manner, having a longer credit history, and showing several good-standing accounts are just a few things that will qualify you for a lower rate.

Years in Business + Financial Health

Being able to show many successful years in business helps you qualify for competitive rates for certain bond types. For example, there are a large number of motor vehicle dealerships across the US. Several new businesses are opening each year, and alternatively, large numbers of dealerships are closing. If you have great credit and 5+ years in business, this will show the surety company you are serious about your company’s success and will qualify you for a lower bond premium.

If you’re a new business, don’t fret. This just means you will qualify for a lower rate the longer that you’re in business, as long as you keep that credit looking good.

Additionally, a company that has had years of experience in the industry is aware of the different claims that arise, so they may better understand the requirements to avoid them.

The financial status of your business is important for surety companies to look into in some cases. This will help show if you have the assets in the case a claim is filed, that you will be able to pay the surety company back for the “line of credit” if a claim occurs.

History of Bond Claims

If your business has experienced any bond claims in the past, the surety company will take that into account when offering you a surety bond rate. The surety bond's history also plays into the bond premium. If a bond type has a history of losses, then rates are higher due to the risk experienced.

The more claims and other disciplinary actions that your business has gives a glance into your risk as a customer to the surety company. It is important that you are ethical in your business practices and ensure you are staying within the guidelines of your bond and license to prevent this from affecting your cost, or even the revocation or suspension of your license.

Conclusion

Now that you know the many factors that affect the cost of your surety bond, get the bond you need in minutes:

Each bond offered by Jet has been thoroughly analyzed. We scrutinize the underwriting process to bring competitive rates to underserved principals.